4wdcentre82.ru

Learn

How Much Weight Can You Lose On A Liquid Diet

Since you're eating a low carb diet, your body's glycogen stores are being depleted. · The liquid diet is probably significantly lower in sodium. About three months before surgery, you'll begin changing your diet in consultation with a dietitian and start losing weight. Depending on your weight, it may be. I have lost about 8 lbs in 1 week while on liquid diet. I was feeling super weak and barely had energy. On no chew diet, I have regained 4 lbs. In this video I complete a 7 day liquid fast and take you along the journey. I explain the side effects, how I'm feeling, and my weight loss. How much weight can you expect to lose from TORe? Your expected weight loss can vary with TORe, and it likely depends on how much weight was regained after. After bariatric surgery you will have a series of meal plans to follow. The High Protein Liquid Meal. Plan is the first of the series and is designed. Liquid diets can lead to rapid weight loss, but it's not necessarily healthy or sustainable. You could lose pounds per week, but it's best. The 3-Day Diet claims dieters can lose up to 10 pounds in three days. Weight loss is possible on The 3 Day Diet, but only because it is very low in calories. Can you lose weight on the clear liquid diet? You might be able to lose some pounds while on the clear liquid diet simply by consuming foods with fewer. Since you're eating a low carb diet, your body's glycogen stores are being depleted. · The liquid diet is probably significantly lower in sodium. About three months before surgery, you'll begin changing your diet in consultation with a dietitian and start losing weight. Depending on your weight, it may be. I have lost about 8 lbs in 1 week while on liquid diet. I was feeling super weak and barely had energy. On no chew diet, I have regained 4 lbs. In this video I complete a 7 day liquid fast and take you along the journey. I explain the side effects, how I'm feeling, and my weight loss. How much weight can you expect to lose from TORe? Your expected weight loss can vary with TORe, and it likely depends on how much weight was regained after. After bariatric surgery you will have a series of meal plans to follow. The High Protein Liquid Meal. Plan is the first of the series and is designed. Liquid diets can lead to rapid weight loss, but it's not necessarily healthy or sustainable. You could lose pounds per week, but it's best. The 3-Day Diet claims dieters can lose up to 10 pounds in three days. Weight loss is possible on The 3 Day Diet, but only because it is very low in calories. Can you lose weight on the clear liquid diet? You might be able to lose some pounds while on the clear liquid diet simply by consuming foods with fewer.

Drink slowly. Sip on liquids throughout the day. At first you must not exceed 1 oz every 15 minutes or 4 oz every hour. Therefore, an eight ounce protein. On average, people have reported losing pounds a week when on a full liquid diet. As weight loss can be significant and quite sudden when following liquid. In the first few weeks, you can expect rapid weight loss because you will begin with a liquid diet. People lose on average about 20 percent of their excess. Following this diet will not only jump start weight loss but will also help reduce the size of your liver • One-A-Day Maximum. • Flinstones Complete. By reducing your calorie intake, liquid diets can contribute to weight loss. Many liquid diet plans begin with a range of to calories per day. By. How much weight will you lose with the gastric sleeve? The average weight loss is 25% to 30 % of your body weight in the first one to two years. That means if. liquid diet plan Liquid Diet Reset, One Week Liquid Diet, How Much Weight Can How Much Weight Can You Lose On A Liquid Diet · Liquid Diet Plan. Liquid Diet Plan To Lose Weight Fast 2 Kg in 1 Day | Liquid Diet for What happens if you Don't Eat for 44 Days? (Fasting Science). When do I need to call the doctor? • If you are losing weight. • If you have any questions about what you can eat. Helpful tips. • Avoid all solid foods. The gastric bypass diet outlines what you can eat and how much after gastric bypass surgery weight, or you may regain any weight that you do lose. Risks. The. "There are very few rewards of going on a liquid diet," says Pojednic. "You may lose a little weight in the short term due to water loss, and perhaps a couple. On average, people have reported losing pounds a week when on a full liquid diet. As weight loss can be significant and quite sudden when following liquid. UPDATED PROTEIN SWITCH: 4wdcentre82.ru We know the key to long lasting weight loss is keeping yourself in a caloric deficit. º Do not use a straw or gulp when you drink (you may swallow too much air or fluid, which can cause pain). • Get a minimum of 48 ounces of fluid daily. Liquid Meal Replacement Plan; Prescription Medications for Weight Loss. You can learn more about each plan below. Do Liquid Diets Work for Weight Loss? The short answer is, yes. “It is restrictive (of calories), so you will lose weight,” says McWhorter. In general, weight. Since you're eating a low carb diet, your body's glycogen stores are being depleted. · The liquid diet is probably significantly lower in sodium. When you start your weight loss journey, you might have questions about what you can eat, how much you can eat and how to keep losing weight successfully. These diets can cause a weight loss of 2 to 4 pounds a week, according to a clinical review published in the September edition of the journal Nutrition. Do Liquid Diets Work for Weight Loss? The short answer is, yes. “It is restrictive (of calories), so you will lose weight,” says McWhorter. In general, weight.

Price Okta

View Okta, Inc. Class A OKTA stock quote prices, financial information, real-time forecasts, and company news from CNN. Okta, Inc. (4wdcentre82.ru): Stock quote, stock chart, quotes, analysis, advice, financials and news for Stock Share Price. Equities. OKTA. US IT. Okta Inc OKTA:NASDAQ · Open · Day High · Day Low · Prev Close · 52 Week High · 52 Week High Date03/08/24 · 52 Week Low · 52 Week Low. View Okta, Inc OKTA investment & stock information. Get the latest Okta, Inc OKTA detailed stock quotes, stock data, Real-Time ECN, charts, stats and more. Okta, Inc. (OKTA) - Price History ; February , $, $ ; January , $, $ ; December , $, $ ; November , $, $ Okta (OKTA) has a Smart Score of 10 based on an analysis of 8 unique data sets, including Analyst Recommendations, Crowd Wisdom, and Hedge Fund Activity.. 1 Forgotten Growth Stock That Could Soar 30%, According to Select Wall Street Analysts. Okta stock is down 30% in the past five years. Stock analysis for Okta Inc (OKTA:NASDAQ GS) including stock price, stock chart, company news, key statistics, fundamentals and company profile. The current price of OKTA is USD — it has decreased by −% in the past 24 hours. Watch Okta, Inc. stock price performance more closely on the chart. View Okta, Inc. Class A OKTA stock quote prices, financial information, real-time forecasts, and company news from CNN. Okta, Inc. (4wdcentre82.ru): Stock quote, stock chart, quotes, analysis, advice, financials and news for Stock Share Price. Equities. OKTA. US IT. Okta Inc OKTA:NASDAQ · Open · Day High · Day Low · Prev Close · 52 Week High · 52 Week High Date03/08/24 · 52 Week Low · 52 Week Low. View Okta, Inc OKTA investment & stock information. Get the latest Okta, Inc OKTA detailed stock quotes, stock data, Real-Time ECN, charts, stats and more. Okta, Inc. (OKTA) - Price History ; February , $, $ ; January , $, $ ; December , $, $ ; November , $, $ Okta (OKTA) has a Smart Score of 10 based on an analysis of 8 unique data sets, including Analyst Recommendations, Crowd Wisdom, and Hedge Fund Activity.. 1 Forgotten Growth Stock That Could Soar 30%, According to Select Wall Street Analysts. Okta stock is down 30% in the past five years. Stock analysis for Okta Inc (OKTA:NASDAQ GS) including stock price, stock chart, company news, key statistics, fundamentals and company profile. The current price of OKTA is USD — it has decreased by −% in the past 24 hours. Watch Okta, Inc. stock price performance more closely on the chart.

The 99 analysts offering price forecasts for Okta have a median target of , with a high estimate of and a low estimate of Historical daily share price chart and data for Okta since adjusted for splits and dividends. The latest closing stock price for Okta as of August In depth view into OKTA (Okta) stock including the latest price, news, dividend history, earnings information and financials. Get the latest Okta Inc (OKTA) real-time quote, historical performance, charts, and other financial information to help you make more informed trading and. Based on 27 Wall Street analysts offering 12 month price targets for Okta in the last 3 months. The average price target is $ with a high forecast of. Analyst Price Targets. Consensus. $ Based on analysts offering 12 month price targets for OKTA in the last 3 months. The average price target is $ Complete Okta Inc. Cl A stock information by Barron's. View real-time OKTA stock price and news, along with industry-best analysis. While ratings are subjective and will change, the latest Okta (OKTA) rating was a reiterated with a price target of $ to $ The current price Okta . Key Stock Data · P/E Ratio (TTM). N/A · EPS (TTM). $ · Market Cap. $ B · Shares Outstanding. M · Public Float. M · Yield. OKTA is not. Get the current share price of Okta (OKTA) stock. Current & historical charts, research OKTA's performance, total return and many other metrics free. The Okta Identity Cloud, a leading solution for securing consumer and SaaS apps, ranges from $15, to $31, for a headcount of , goes up to $33, to. Okta is a cloud-native security company that focuses on identity and access management. The San Francisco-based firm went public in and focuses on two key. Okta Inc (OKTA) stock price, GURU trades, performance, financial stability, valuations, and filing info from GuruFocus. OKTA stock price, live market quote, shares value, historical data, intraday chart, earnings per share and news. View today's Okta Inc stock price and latest OKTA news and analysis. Create real-time notifications to follow any changes in the live stock price. Discover real-time Okta, Inc. Class A Common Stock (OKTA) stock prices, quotes, historical data, news, and Insights for informed trading and investment. With Wise, access the real, mid-market exchange rate for seamless and cost-effective trades worldwide. Banks often advertise free or low-cost transfers, but add. Get Okta Inc (4wdcentre82.ru) real-time stock quotes, news, price and financial information from Reuters to inform your trading and investments. USD each. The Okta Certified Consultant Exam is priced at $ USD. The retake price for the Okta Certified Professional, Okta Certified Administrator, Okta. Okta's Workforce and Customer Identity Clouds enable secure access Pricing · Contact Sales · Trust · Accessibility. Help & Support. Help and Support.

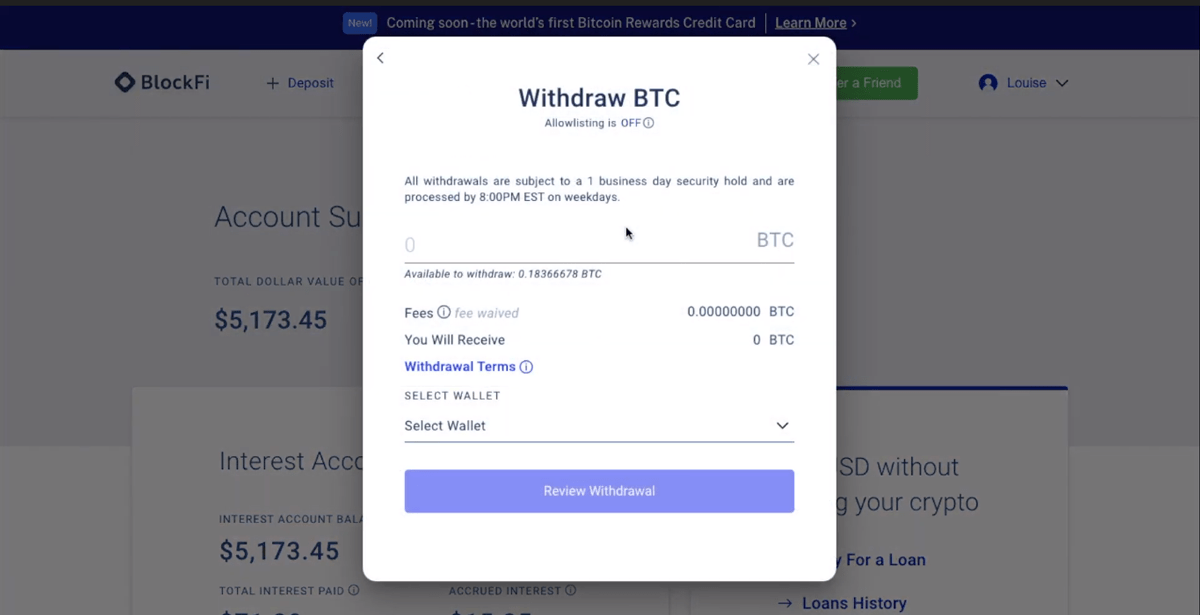

How To Withdraw Money From Blockfi

BlockFi halted withdrawals on November 10, , shortly before filing for bankruptcy on November 28, The decision was influenced by its significant. The New Jersey-based firm said its Coinbase partnership will allow eligible BlockFi Interest Account, Retail Loan, and Private Clients to withdraw their crypto. You can find BlockFi's Help Center by clicking here. Please note that the window to submit estate withdrawal requests closed on April 28, at PM UTC. Does BlockFi offer free withdrawals?Keep in mind, BlockFi only offers 1 free withdrawal per month from the interest account. You may want to consolidate all. Also, has anyone had trouble withdrawing the funds? https: //4wdcentre82.ru?ref=d79d81a2. 4wdcentre82.ru Do More with Your Crypto. 4 yrs. Attila. funds from FTX. Struggling crypto lender BlockFi is winding down operations and withdraw their cryptocurrency holdings. In November BlockFi is pleased to announce Coinbase as our distribution partner to ensure continuity of crypto withdrawals available to our eligible BlockFi Interest. BlockFi has emerged from bankruptcy and Coinbase, a distribution partner for its retail creditors, will be helping to distribute crypto assets. Cash is not. As previously announced, the BlockFi web platform will shutdown by May 31, at PM UTC. After this date clients will no longer be able to access the. BlockFi halted withdrawals on November 10, , shortly before filing for bankruptcy on November 28, The decision was influenced by its significant. The New Jersey-based firm said its Coinbase partnership will allow eligible BlockFi Interest Account, Retail Loan, and Private Clients to withdraw their crypto. You can find BlockFi's Help Center by clicking here. Please note that the window to submit estate withdrawal requests closed on April 28, at PM UTC. Does BlockFi offer free withdrawals?Keep in mind, BlockFi only offers 1 free withdrawal per month from the interest account. You may want to consolidate all. Also, has anyone had trouble withdrawing the funds? https: //4wdcentre82.ru?ref=d79d81a2. 4wdcentre82.ru Do More with Your Crypto. 4 yrs. Attila. funds from FTX. Struggling crypto lender BlockFi is winding down operations and withdraw their cryptocurrency holdings. In November BlockFi is pleased to announce Coinbase as our distribution partner to ensure continuity of crypto withdrawals available to our eligible BlockFi Interest. BlockFi has emerged from bankruptcy and Coinbase, a distribution partner for its retail creditors, will be helping to distribute crypto assets. Cash is not. As previously announced, the BlockFi web platform will shutdown by May 31, at PM UTC. After this date clients will no longer be able to access the.

BlockFi was founded in The company has received funding from investors such as Coinbase Ventures, Pomp Investments, and Bain Capital Management. BlockFi. Bitcoin Withdrawals · Toggle from USD to BTC by tapping “USD” on your Cash App home screen. · Select Bitcoin · Enter the amount of Bitcoin you want to withdraw . and acts as a money transmitter that accepts money and digital assets from investors and transfers the funds to BlockFi for investment in BIAs. 5. BlockFi. Similarly, for some assets, you get one free withdrawal a month while for others you are charged a fee every time you withdraw. This makes calculating BlockFi. Withdrawals will be processed in batches, and users can expect to receive an email as soon as they become eligible to start withdrawing their funds. During this. The company announced in a blog post that “eligible BlockFi Interest Accounts (BIA), Retail Loans, and Private Clients” can withdraw funds. funds to BlockFi for investment in BIAS. 4 BIA investors were permitted to withdraw the equivalent to the digital assets they loaned to BlockFi. Withdrawing funds from your BlockFi account: FAQ. How do I withdraw money? How long will it take to receive my funds? Can I cancel my withdrawal request? The hole in FTX's balance sheet seems to be around $9 Billion. Other FTX Group-owned companies halt withdrawals including BlockFi. Many other crypto. withdraw virtual and fiat currency from its platform (“Platform Suspension”). BlockFi to engage in the business of money transmission in. Connecticut was. Please note that the window to submit estate withdrawal requests closed on April 28, at PM UTC. All identity verification information requests must. Withdrawing funds from your BlockFi account: FAQ. How do I withdraw money? How long will it take to receive my funds? Can I cancel my withdrawal request? It is registered as a money transmitter in Washington (WA Lic. # 1 BlockFi allows customers to withdraw their virtual currency from their BIA at any. Similarly, for some assets, you get one free withdrawal a month while for others you are charged a fee every time you withdraw. This makes calculating BlockFi. Zengo makes it easy to withdraw funds to another wallet or cash out in fiat. To withdraw to another wallet, simply open the app, select “Actions,” and tap the “. Only funds held in “BlockFi Wallet” can be withdrawn, under a prior order of the Bankruptcy Court. Withdrawals from those accounts are anticipated to begin this. No Early Withdrawal Penalties: The BlockFi Interest Account (BIA) offers up to one free withdrawal per month. There are no early withdrawal penalties. Savings. The New Jersey-based firm said its Coinbase partnership will allow eligible BlockFi Interest Account, Retail Loan, and Private Clients to withdraw their crypto. funds from FTX. Struggling crypto lender BlockFi is winding down operations and withdraw their cryptocurrency holdings. In November and acts as a money transmitter that accepts money and digital assets from investors and transfers the funds to BlockFi for investment in BIAS. 4. BlockFi.

Who To Issue 1099s To

You only have to complete it for business-related payments — not for personal expenses. You don't need to issue a if you paid someone $ for personal. This income may include interest from your bank, dividends from investments, or compensation for freelance work. Issuers of forms must send one copy to the. They should use Form NEC to file their U.S. federal income tax and state tax returns (usually on Schedule C). Independent contractors are self-employed. Form is one of several IRS tax forms (see the variants section) used in the United States to prepare and file an information return to report various. If you have 10 or more information returns, you must file them electronically. This includes Forms W-2, e-filed with the Social Security Administration. Yes. The reporting of payments on Form MISC and NEC can be submitted to the Louisiana Department of Revenue through the IRS's Combined Federal/State. In general, you don't have to issue NEC forms to C-Corporations and S-Corporations. It's a common belief that businesses don't need to send out NEC. The payers of these types of income must send one copy of the form to the. IRS and another copy to the recipient of these payments. 2. What types of So who gets a NEC? Typically, this form is issued to independent contractors, janitorial services, third-party accounts and any other worker paid for. You only have to complete it for business-related payments — not for personal expenses. You don't need to issue a if you paid someone $ for personal. This income may include interest from your bank, dividends from investments, or compensation for freelance work. Issuers of forms must send one copy to the. They should use Form NEC to file their U.S. federal income tax and state tax returns (usually on Schedule C). Independent contractors are self-employed. Form is one of several IRS tax forms (see the variants section) used in the United States to prepare and file an information return to report various. If you have 10 or more information returns, you must file them electronically. This includes Forms W-2, e-filed with the Social Security Administration. Yes. The reporting of payments on Form MISC and NEC can be submitted to the Louisiana Department of Revenue through the IRS's Combined Federal/State. In general, you don't have to issue NEC forms to C-Corporations and S-Corporations. It's a common belief that businesses don't need to send out NEC. The payers of these types of income must send one copy of the form to the. IRS and another copy to the recipient of these payments. 2. What types of So who gets a NEC? Typically, this form is issued to independent contractors, janitorial services, third-party accounts and any other worker paid for.

Only file s with the SCDOR if you withheld South Carolina Income Tax. Do not send s to the. SCDOR that do not report South Carolina Income Tax. Who is required to send s to Treasury? Any that indicates Michigan withholding must be filed directly with Treasury, regardless of residency status. These forms are used to report payments for rent, services, contractors, and other miscellaneous income payments. Features of the application include: MISC. Businesses that issue s must also submit their information returns using iWire*. We don't accept information returns in any other format. Filing. Here are some guidelines to help determine if a vendor needs to be set up as a vendor. Rules & Regulations. Who must file? Persons engaged in a trade. You may have to file Form NEC, Nonemployee Compensation, to report payments you make to independent contractors. While property managers are exempt from receiving s for rental income received (even from a tenant renting a commercial space), the PM company itself is. Who needs to issue 's? You must issue a MISC if you paid a non-employee individual or business (other than an incorporated business) $ or more to. forms are for reporting payments outside of regular earnings. Learn which you need and how to file with the IRS. Give form to the requester. Do not send to the IRS. Form W Request for Taxpayer. Identification Number and Certification. The reason is IRS Form provides the means of reporting very specific types of income from non-employment related sources that might not be reported. Businesses file a MISC when purchasing services (not goods) from unincorporated vendors (not corporations). For example: REPORT a $ purchase of computer. A tax form is used to report various types of income and payment transactions. For example, a marketplace may issue s to summarize earnings for. File your with the IRS for free. Free support for self-employed income, independent contractor, freelance, and other small business income. For your contingent workforce, you would generally issue Form NEC file s with the IRS. It's important to review IRS instructions to ensure. Submit an IRS formatted file (for Forms MISC, NEC, R, K, W-2G, etc.) through the department's website. For more. Our filing software makes it simple to create, issue, send and e-file your NEC, MISC and more. Get started with a free trial today! For the tax year, third-party processors need to send you a K only if you conducted more than transactions totaling at least $20, in gross. Lawyers must issue Forms to expert witnesses, jury consultants, investigators, and even co-counsel where services are performed and the payment is $ or. The basic rule is that you must file a NEC whenever you pay an unincorporated independent contractor—that is, an independent contractor who is a sole.

3 4 5 6 7