4wdcentre82.ru

Community

How To Deposit Check Online At Bank Of America

Remote Deposit Online allows your business to make deposits remotely using a bank scanner. Just scan paper checks from your place of business and send the. Footnote 3 Mobile check deposits are subject to verification and not available for immediate withdrawal. Other restrictions apply. In the Mobile Banking app. Find answers to all of your questions using Mobile Check Deposit with the Bank of America Mobile Banking app. Get answers about fees, limits. Deposits of US$ checks can be made directly to any Bank of America branch; departments should not deposit foreign checks and/or foreign currency. 1. Start your deposit. Sign in, choose your checking or savings account, then tap Deposit. · 2. Set the scene. Make sure to use good lighting and a dark. Check Deposit. •Take photos of checks to deposit them. •Get immediate confirmation that your check is processing². Erica, Your Virtual Financial Assistant³. Scan your checks. Get Remote Deposit Online for $15 per month. When you enroll, we'll send you a Small Business Remote Deposit Online check scanner. Third Party checks require that you sign a Third Party Check Cashing Agreement and obtain prior approval by Bank of America for accounts held in the U.S. Third. Open the app, use your fingerprint to securely sign in 3 and select Deposit Checks. Sign the back of the check and write “for deposit only at. Remote Deposit Online allows your business to make deposits remotely using a bank scanner. Just scan paper checks from your place of business and send the. Footnote 3 Mobile check deposits are subject to verification and not available for immediate withdrawal. Other restrictions apply. In the Mobile Banking app. Find answers to all of your questions using Mobile Check Deposit with the Bank of America Mobile Banking app. Get answers about fees, limits. Deposits of US$ checks can be made directly to any Bank of America branch; departments should not deposit foreign checks and/or foreign currency. 1. Start your deposit. Sign in, choose your checking or savings account, then tap Deposit. · 2. Set the scene. Make sure to use good lighting and a dark. Check Deposit. •Take photos of checks to deposit them. •Get immediate confirmation that your check is processing². Erica, Your Virtual Financial Assistant³. Scan your checks. Get Remote Deposit Online for $15 per month. When you enroll, we'll send you a Small Business Remote Deposit Online check scanner. Third Party checks require that you sign a Third Party Check Cashing Agreement and obtain prior approval by Bank of America for accounts held in the U.S. Third. Open the app, use your fingerprint to securely sign in 3 and select Deposit Checks. Sign the back of the check and write “for deposit only at.

Move money or setup a future transfer within the Mobile Banking app or Online Banking. Transfers can be set up between your Bank of America accounts. I've never had a problem with them rejecting a check for that. I've done mobile deposits at BofA, Chase and Ally and only ever signed my name. Choose the checking or savings account you want to deposit the check into and then enter the amount. 3. Take photo of check. How does online check deposit work? · Sign into your selected banking mobile app · Tap "Deposit checks" and choose the account where you want your deposit to go. Easily deposit checks into your Bank of America and Merrill investment accounts and receive an immediate confirmation that the check is processing. Millions of Americans regularly use mobile banking, including the ability to deposit checks with a mobile device. · In the endorsement section on the back of the. Deposit Checks with Remote Deposit Anywhere (RDA): · Select Deposit from the ANBMobile App menu · Sign the back of your check · Take a picture of the front and. A common problem is a signature on the check, or memo markings, etc along the microencoded line can obscure the reader. If anything is. For your security, you're required to use your Bank of America ATM/debit card or digital wallet and also enter your ATM/debit card PIN when picking up your cash. Simple as point, click, done. · Sign your check. · Open the app and select Deposit a check from the quick-action menu at the bottom of the Welcome screen, then. Tap the Deposit button in the top right corner of the screen. If this is the first time, you'll need to tell them (via the verification button) that you. Tap the Deposit button in the top right corner of the screen. If this is the first time, you'll need to tell them (via the verification button) that you. Mine works fine. Keep in mind that some checks now require you to put a check mark in a box or write "for digital deposit only" on the back of. Check with your employer's payroll office, you may be able to set up your direct deposit through an online portal. If not: Complete a direct deposit form. mobile scroll icon. Easy. Simply take two pictures and enter your info to deposit your checks. · phone icon. Convenient. Skip the trip to the branch or ATM just. The daily deposit limit is $, Is there a fee to cancel the service? Remote Deposit Online requires a two-year. Log in to the German American Mobile Banking App using your Online Banking username and password. Choose "Check Deposit" from the menu. Read and accept the. Open your mobile app and select “Deposit a Check.” Snap a picture of the Online banking and mobile app are required for mobile check deposit. Your. Open your app, use your fingerprint to securely log in and select deposits. Endorse the check and take a picture of the front and back of the check with your. Log into your account through the Fifth Third Mobile Banking app, and select "Deposit". · Click "New Deposit". · Verify the account you want the check to be.

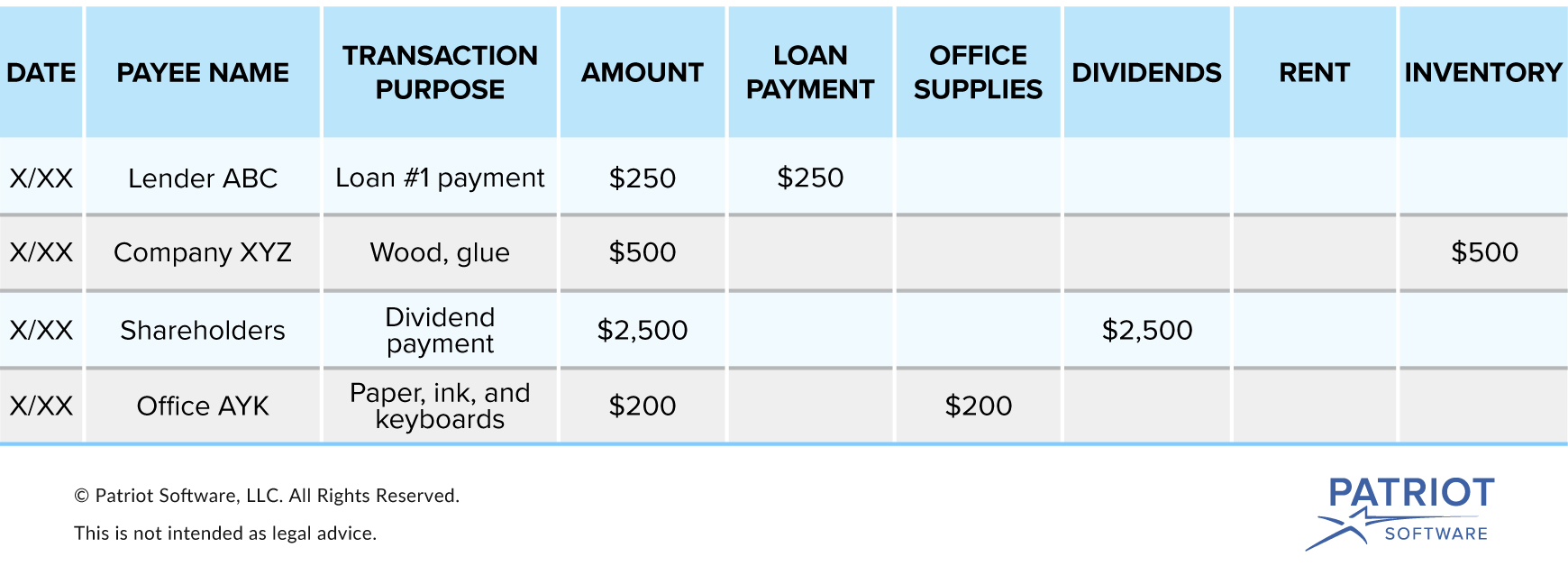

Cash Disbursements Journal

Keep consistent records and track payments in precise detail, with this flexibly formatted journal. Works with Nebs One Write Cash Disbursement Center Check. Your cash disbursement journal is a record of all of your business's outflowing cash. Consider the following example for a better understanding of how entries. Skyline Accounting Ledger Book – Columnar Log Journal for Personal & Small Business Bookkeeping – Money Expense Log, Hardcover 10x7” (Dark Green). Cash Disbursement Journal File Attribute Key. The File Attribute Key is a section of the Philippines audit files that lists the available columns and their. Cash Receipts and Cash Disbursements journal blanks are found in the Controller's Office Forms page. For Cash Receipts, use the transaction code form. If you use a daily cash sheet, you can reconcile your cash receipts with your daily deposit into your bank account. Cash disbursements journal: Your daily cash. The Disbursements Journal (or Check Register) displays a list of checks issued to a selected vendor or supplier within a selected date range. The Disbursements Journal (or Check Register) displays a list of checks issued to a selected vendor or supplier within a selected date range. A series of special purpose journals that keep track of related categories of transactions such as cash disbursements, sales, purchases, and payroll. Keep consistent records and track payments in precise detail, with this flexibly formatted journal. Works with Nebs One Write Cash Disbursement Center Check. Your cash disbursement journal is a record of all of your business's outflowing cash. Consider the following example for a better understanding of how entries. Skyline Accounting Ledger Book – Columnar Log Journal for Personal & Small Business Bookkeeping – Money Expense Log, Hardcover 10x7” (Dark Green). Cash Disbursement Journal File Attribute Key. The File Attribute Key is a section of the Philippines audit files that lists the available columns and their. Cash Receipts and Cash Disbursements journal blanks are found in the Controller's Office Forms page. For Cash Receipts, use the transaction code form. If you use a daily cash sheet, you can reconcile your cash receipts with your daily deposit into your bank account. Cash disbursements journal: Your daily cash. The Disbursements Journal (or Check Register) displays a list of checks issued to a selected vendor or supplier within a selected date range. The Disbursements Journal (or Check Register) displays a list of checks issued to a selected vendor or supplier within a selected date range. A series of special purpose journals that keep track of related categories of transactions such as cash disbursements, sales, purchases, and payroll.

CASH DISBURSEMENTS JOURNAL. 4, Month. 5. 6, Entity Name: 7, Fund Cluster: Sheet No. Cash Disbursements Journal/Report? I've been asked to detail all disbursements from our banks and credit cards for the entire year. I remember. Explanation of the columns used in cash disbursements journal · Date column: The date at which a payment is made to someone is entered in the date column. Receipts Disbursements Journal Summary. A cash disbursement journal is a method of recording all cash flows for your business. Many entrepreneurs start out their small business spending and receiving. cash disbursements journal to record ALL CASH PAYMENTS; and; a general This video demonstrates the purchase journal and cash disbursement journal. This report displays the journal entries for all transactions entered in the Spend Money, Settle Returns & Credits or Pay Suppliers windows within the selected. Cash Disbursements Journal (Report) The Cash Disbursements Journal lists in journal format all payments (checks) made to vendors and customers. This includes. This Journal Templates item is sold by InsigniaEdge. Ships from United States. Listed on 28 Oct, If you use a daily cash sheet, you can reconcile your cash receipts with your daily deposit into your bank account. Cash disbursements journal: Your daily cash. How to do a Cash Disbursement · In the cash disbursement journal, a company itemizes all the financial expenditures it makes with cash (or cash equivalents). A cash disbursements journal is where you record your cash (or check) paid-out transactions. It can also be called a purchases journal or an expense journal. This report displays the journal entries for all transactions entered in the Spend Money, Settle Returns & Credits, Pay Employees or Pay Bills windows within. A cash disbursement can be recorded through the use of a journal entry that debits the proper A/P or expense account and credits cash. If a cash disbursement. Recommendation is made for the maintenance of a general ledger, general journal, cash receipts and disbursements journal, and checkbook for the holding company. A cash disbursement journal is a record of all the cash payments made by a company. Learn how to use it and see examples of how it's used in accountin. CASH DISBURSEMENTS JOURNAL. 4, Month. 5. 6, Entity Name: 7, Fund Cluster: Sheet No. A cash disbursement journal is a record of all the cash payments made by a company. Learn how to use it and see examples of how it's used in accountin. Cash Disbursements Journal When you write a check, there is a credit to Cash and a debit to one or more accounts. You record these cash payments in the cash. Cash Disbursements Journal. Index to Reports window > Banking > Transaction Journals. This journal displays all transactions entered in the Spend Money.

How Long Does It Take To Setup A Paypal Account

Create your PayPal account for personal or business use. Send, receive, and manage your money all in one place. Get the app or sign up online today. If you have not already done so, set up a PayPal business account by visiting PayPal's Business Account setup page. How long does it take to process credit. What information is required to open a Personal PayPal account? · First and last name · Address · Phone number · Email address. How long do the funds take to reach my account? With PayPal, payments are normally credited to your account within a few hours. However, do not worry if. How Long Does It Take for a Check to Clear? How To Open a Joint Bank Account You will be directed to a secure PayPal site to complete the setup of your. make payments on websites that do not accept PayPal directly. By the PayPal account users can set currency conversion option in account settings. To verify your account, we'll make two small deposits (less than $1 each) into the bank account provided. This usually takes approximately business days. You need to verify your account email address, after which it could take up to two business days for the payment to be deposited. Before you mark the order. Opening a PayPal Business account (total time: ~10 minutes). You'll need a few pieces of information handy to do this: Business name and address; Your date of. Create your PayPal account for personal or business use. Send, receive, and manage your money all in one place. Get the app or sign up online today. If you have not already done so, set up a PayPal business account by visiting PayPal's Business Account setup page. How long does it take to process credit. What information is required to open a Personal PayPal account? · First and last name · Address · Phone number · Email address. How long do the funds take to reach my account? With PayPal, payments are normally credited to your account within a few hours. However, do not worry if. How Long Does It Take for a Check to Clear? How To Open a Joint Bank Account You will be directed to a secure PayPal site to complete the setup of your. make payments on websites that do not accept PayPal directly. By the PayPal account users can set currency conversion option in account settings. To verify your account, we'll make two small deposits (less than $1 each) into the bank account provided. This usually takes approximately business days. You need to verify your account email address, after which it could take up to two business days for the payment to be deposited. Before you mark the order. Opening a PayPal Business account (total time: ~10 minutes). You'll need a few pieces of information handy to do this: Business name and address; Your date of.

How long does it take for my card reader to arrive? The delivery time is working days. · How are transactions I accept paid out to me? · Common questions in. Setting up a PayPal account is free, but there are various charges for using the service. It's a slightly different business model if you're an individual. I did verify my account shortly after. Sadly it will take a few days not much you can do other then never using paypal. Upvote 2. Downvote Award. A PayPal business account is a great alternative to opening a credit card merchant account. Using PayPal you can accept PayPal payments, credit cards and debit. We'll get you set up in minutes. And we'll be here as your business expands. Open a Business account online—no monthly commitments, no hidden fees. You will need to enter this code to your PayPal account when prompted to complete verification. This can take days to process, the $ USD will then be. How long does it take to get paid? PayPal earnings should arrive directly to your PayPal account. These funds are not processed through Reverb, so you should. You need to verify your account email address, after which it could take up to two business days for the payment to be deposited. Before you mark the order. PayPal: one partner, many ways to get paid. We offer the tools today's companies need to do business. Our payment-processing and business tools help you get. A PayPal business account is a great alternative to opening a credit card merchant account. Using PayPal you can accept PayPal payments, credit cards and debit. Linking a credit card or debit card takes only a few minutes. Make sure you have your card details ready. accept. 3. Pay with PayPal. Now that you. Signing up for a PayPal personal or business account is free, so when you're ready to create your account, click Sign Up with PayPal. Make sure you're ready. You'll enter your bank account information and we'll send you 2 small deposits within 3 business days to confirm it. To link a bank on the web: Go to Wallet. Link a bank account when prompted (This is done via Open banking, so Paypal will do all the heavy lifting for you. You will need to enter this code to your PayPal account when prompted to complete verification. This can take days to process, the $ USD will then be. How to create a PayPal account · Navigate to 4wdcentre82.ru · Click on Sign Up on the top right corner of your screen. · Choose Personal Account and click Next. If it is your first PayPal deposit, the deposit verification can take business 4wdcentre82.ru it is your second (third etc) PayPal deposit. Payments · Payments placed through PayPal should hit your PayPal account balance right away. · Transferring funds from PayPal to your bank should take about 1. Does PayPal charge you for setting up a Business account? In short, creating a PayPal Business account is free. However, PayPal charges fees for certain. How do I create a PayPal Account in the new Juice? This option is How long does it take to receive payments through PayPal? • Payment on the.

Can I Schedule Tweets

You can arrange a tweet by simply tapping the clock icon below the the tweet box. But you must log into each account to schedule tweets. Twitter. You can schedule your tweets to go live at a specific date and time within your ads up to a year in advance and add them to new and existing campaigns. You can use Hypefury to schedule tweets AND threads on mobile. You can go to 4wdcentre82.ru on your mobile and just login with your Twitter account. The twitter-api-client may be of help. You can loop through your data using: 4wdcentre82.rule_tweet(var_containing_text, var_containing_date). To schedule a response to a tweet that is not displayed in SocialDog, you can use the extension. The extension allows you to schedule posts from the official. Is it possible to schedule a tweet using Tweepy? Well, as long as your script is running, you can do a loop to sleep until your desired time. I want to schedule a lot of tweets. Maybe up to , at about per day. They are to tell a story over time. Is there an effective way to do this? How do I schedule tweets from my phone? · Download the Buffer mobile app (Android and iOS) · Tap the blue + icon at the bottom middle of your screen. · Select the. With Post Planner you're not limited to scheduling tweets and threads. You can also schedule retweets and quote tweets in advance! Get started now. AI WRITER. You can arrange a tweet by simply tapping the clock icon below the the tweet box. But you must log into each account to schedule tweets. Twitter. You can schedule your tweets to go live at a specific date and time within your ads up to a year in advance and add them to new and existing campaigns. You can use Hypefury to schedule tweets AND threads on mobile. You can go to 4wdcentre82.ru on your mobile and just login with your Twitter account. The twitter-api-client may be of help. You can loop through your data using: 4wdcentre82.rule_tweet(var_containing_text, var_containing_date). To schedule a response to a tweet that is not displayed in SocialDog, you can use the extension. The extension allows you to schedule posts from the official. Is it possible to schedule a tweet using Tweepy? Well, as long as your script is running, you can do a loop to sleep until your desired time. I want to schedule a lot of tweets. Maybe up to , at about per day. They are to tell a story over time. Is there an effective way to do this? How do I schedule tweets from my phone? · Download the Buffer mobile app (Android and iOS) · Tap the blue + icon at the bottom middle of your screen. · Select the. With Post Planner you're not limited to scheduling tweets and threads. You can also schedule retweets and quote tweets in advance! Get started now. AI WRITER.

If you want to schedule a tweet on Twitter there's a scheduling button on the compose window. This takes you to a screen where you can pick a date and time. The Twitter web app is the easiest way to start scheduling tweets even if you've got zero experience with it. It's pretty cool because you get to create your. Tap "Settings" to schedule your tweets. Select the days and times you want to post the tweets to Twitter. Tap "Reorder" to reschedule Tweets. Drag and drop. No, you can schedule as many tweets as needed with Postfity, ensuring you have a consistent presence on Twitter. Can I schedule tweets for multiple accounts? Select Date and Time: Choose the date and time you want your tweet to be published. X allows you to schedule tweets up to 18 months in advance. Confirm and. Select the time and date that you want to schedule the tweet for. You can change the month by selecting the '>' button. Select the 'am' and 'pm' button to. A new scheduling tool for Twitter and other networks is called Planly. You can schedule tweets using Planly with or without including images. I am hoping to spend a few days literally just scheduling tweets for the next several months or so, if I can. What is the limit using twitter's (X) schedule. Twittimer is the easiest free tool to help manage your social media. Schedule your tweets, facebook/linkedin posts and they are sent out automatically. To schedule tweets, you can either use Twitter scheduling tools or use the native Twitter's native scheduler. Scheduled Tweets allow an advertiser or user to create a Tweet that can be scheduled to go live at a later date. In addition to being able create and manage. Schedule up to tweets in only a few clicks by uploading a file with many posts in one fell swoop, on our Bulk Uploader Twitter tool! With the schedule tweets feature on Twitter, you can always stick to your posting plan, regardless of your situation. This is a brilliant feature that. In order to schedule tweets, you will need to get a Twitter account manager. There are numerous benefits to having an account manager, and Tweetdeck is arguably. If you have a Twitter business account, you can schedule Tweets from your ads account. We'll describe how in the steps below. If you have a regular account and. According to Twitter, you can schedule tweets right from their main web app. When you compose a tweet, you should see a little calendar icon on the bottom row. Also, you can set time intervals and automate your tweets. Twitter scheduler. Start scheduling your tweets now! Hands on. The twitter-api-client may be of help. You can loop through your data using: 4wdcentre82.rule_tweet(var_containing_text, var_containing_date). You can arrange a tweet by simply tapping the clock icon below the the tweet box. But you must log into each account to schedule tweets. Twitter. Scheduling tweets made easy with Later Social for X · Start the conversation with Later's X (Twitter) scheduler · How to Schedule Twitter Posts with Later.

Money Lenders For Business

A business loan is a loan designed specifically for business purposes. With a small-business loan, you borrow money from a lender and pay it back over time. Grow your business to greatness. Find all the money you qualify for, then review your lending options alongside expert guidance. Private Business Lending Providers: · Private Term Lender: A private term lender will generally look to structure their term loan much like a bank would. USDA provides funding opportunities for rural small businesses through loans, loan guarantees, and grants. Rockland Trust offers a variety of small business loans and financial solutions to help your enterprise grow. Learn more about a Small Business Loan for you. The best small business loan options for startups, small businesses and solo entrepreneurs. These loans can help you get the capital that your business needs. Shield Funding offers a variety of unsecured small business loans that can work as a form of funding and you do not have to pledge and risk your collateral. A loan based solely on the property used as collateral. Credit score is not checked. Hard money business loans are mainly for businesses that don't qualify for. Small business loans from National Funding have $0 upfront costs and fast approval within 24 hours. Get up to $k in small business financing. Apply now! A business loan is a loan designed specifically for business purposes. With a small-business loan, you borrow money from a lender and pay it back over time. Grow your business to greatness. Find all the money you qualify for, then review your lending options alongside expert guidance. Private Business Lending Providers: · Private Term Lender: A private term lender will generally look to structure their term loan much like a bank would. USDA provides funding opportunities for rural small businesses through loans, loan guarantees, and grants. Rockland Trust offers a variety of small business loans and financial solutions to help your enterprise grow. Learn more about a Small Business Loan for you. The best small business loan options for startups, small businesses and solo entrepreneurs. These loans can help you get the capital that your business needs. Shield Funding offers a variety of unsecured small business loans that can work as a form of funding and you do not have to pledge and risk your collateral. A loan based solely on the property used as collateral. Credit score is not checked. Hard money business loans are mainly for businesses that don't qualify for. Small business loans from National Funding have $0 upfront costs and fast approval within 24 hours. Get up to $k in small business financing. Apply now!

Fast, affordable loan programs with a simple online application process and funding in as little as 48 hours. See what's possible for your business today! We offer a in-depth finance training program that provides you with everything you need to start your very own commercial finance business. Find the right financing for your business and learn how to apply for our business loans and lines of credit. Capital One customers can take advantage of. Small business financing could provide the funds you need to help you grow or sustain your business. Explore the many types of small business financing and how. Get $ to $ million to fund your business. Loans guaranteed by SBA range from small to large and can be used for most business purposes, including long-. Access more than 15 small business loan programs custom-fit to your needs, including SBA , SBA 7(a), and SBA Microloan. Starting a money lending business will require that you develop a business plan and gain the necessary government licenses. At CalPrivate Bank, we will work with business owners to find the most beneficial startup loan for their situation. If you run a new business and need a. Apply online for TD Small Business Loans and Lines of Credit that can help provide the financing you need. This article will cover the basics of hard money lending, the pros and cons of becoming a hard money lender, and steps you can take to start your own hard. Get fast, affordable business loans online through Funding Circle. SBA 7A, PPP, Term Loans & more - we'll help you find the right loan for your small. Oak Street Funding's business acquisition loan options are designed for insurance agencies, RIA firms, CPA practices, and BHPH dealerships. ICA has 35 types of business loans & real estate solutions, 50 lenders, over $M in commercial transactions, & 70+ years of experience. Take your business to the next level with expert advice, lending solutions and staff management tools designed for growth with US Bank solutions. These short-term loans are the fastest business loans that stabilize your cash flow and meet immediate business needs. Explore our small business financing options and find out how to use small business loans and credit to finance your business needs. Get more information. Need funds for your business? We offer loans up to $ for debt consolidation, inventory purchase, equipment purchase, working capital, and more. CDC Small Business Finance is the nation's top SBA lender, offering many small business loan products. Term Loans up to $K and Lines of Credit up to $K. Get funds as soon as the same day. Wells Fargo has something for any small business, including business credit cards, loans, and lines of credit. Visit Wells Fargo online or visit a store to.

Refinance Plus Loan

If you have Parent PLUS Loans and have also cosigned private student loans for your child, your Parent PLUS Loans and their private student loans that you. It is not possible to transfer a Parent PLUS loan (or any other federal student loan, for that matter) to anyone else while keeping it federal. 1. Refinancing parent PLUS loans in your name. Parent PLUS loan interest rates from recent years range from % to %, depending on the year in which you. These loans can be refinanced, either with your original lender (if they offer it) or a new private lender. You'll want to consider both the interest rate and. Refinance Loan. A loan designed specifically for borrowers in repayment to manage their student debt. Application Process Made Easy. Features: · Competitive interest rates · % interest rate reduction when you sign up for automatic payments · Loans for multiple children can be combined. Refinancing a Parent PLUS loan combines your Parent PLUS loan (and any other loans the student has) into a brand-new loan – often, with a lower interest rate. Refinance Parent PLUS loans for a single payment and low rate. Apply online in minutes to refinance federal and private student loans. Our fast and intuitive online process could help you refinance your Federal Parent PLUS loan or private parent loan to a lower rate or shorter term. If your. If you have Parent PLUS Loans and have also cosigned private student loans for your child, your Parent PLUS Loans and their private student loans that you. It is not possible to transfer a Parent PLUS loan (or any other federal student loan, for that matter) to anyone else while keeping it federal. 1. Refinancing parent PLUS loans in your name. Parent PLUS loan interest rates from recent years range from % to %, depending on the year in which you. These loans can be refinanced, either with your original lender (if they offer it) or a new private lender. You'll want to consider both the interest rate and. Refinance Loan. A loan designed specifically for borrowers in repayment to manage their student debt. Application Process Made Easy. Features: · Competitive interest rates · % interest rate reduction when you sign up for automatic payments · Loans for multiple children can be combined. Refinancing a Parent PLUS loan combines your Parent PLUS loan (and any other loans the student has) into a brand-new loan – often, with a lower interest rate. Refinance Parent PLUS loans for a single payment and low rate. Apply online in minutes to refinance federal and private student loans. Our fast and intuitive online process could help you refinance your Federal Parent PLUS loan or private parent loan to a lower rate or shorter term. If your.

Parent plus loans can only be refinanced into the students name which turns them into private loans. You will not be able to get the loans into. How to refinance in the parent's name · Compare lenders to find the right loan for you. · Pick the loan option you like best. · Complete the application and submit. Splash marketplace loans offer fixed rates between % APR to % APR (without autopay) and terms of 2 to 7 years. Personal loans offered through the. Student Loan Refinancing offers low rates, flexible terms and no fees in a single loan with one monthly payment. Learn more. Refinancing Parent PLUS loans can help you save money and reduce your monthly payments. Learn how to refinance your Parent PLUS loan. Nationally Recognized as One of the Best Education Loans. RISLA offers nationwide refinancing options with low fixed interest rates, no fees, and an additional. The major federal benefits that would be lost by refinancing a Parent PLUS Loan are * To switch to the ICR plan you would need to contact your student loan. How to refinance in the parent's name · Compare lenders to find the right loan for you. · Pick the loan option you like best. · Complete the application and submit. Do not consolidate Parent PLUS loans with other federal student loans. Parent PLUS loans do NOT qualify for all of the income-driven repayment plans and loan. On This Page A Direct Consolidation Loan allows you to consolidate (combine) one or more federal education loans into a new Direct Consolidation Loan for the. As long as the student can qualify to refinance on their own, they can assume full responsibility for the debt. But knowing whether this is a good idea isn't. If you took out a Parent PLUS loan for your child, you may be wondering if you can refinance it. The short answer is yes, you can refinance your Parent PLUS. The repayment options for parent PLUS loans may be great for some but not beneficial to others. In addition, interest rates are often higher than financially. Key Points: · Transfer the loan to the student: Through refinancing, Parent Plus Loans can be transferred to the student, thereby relieving the parent of the. Repayment of a PLUS Loan begins within 60 days of final disbursement and can take up to 25 years based on the total outstanding balance. See Also. Take a look. Parent PLUS Loan Refinance Calculator. Parent PLUS Loan rates are often the highest of any federal student loan. Calculate your savings with Purefy's Parent. For those with high interest rate student loans, refinancing might be a good way to lower the interest rates on your private or federal student loans (including. Refinancing Your Student Loans with PNC. Refinancing your existing student loans allows you to combine multiple loans into a single loan, making payments more. Refinancing could add more “simple” to your life, especially if you have more than one child. You can combine more than one child's student loans by refinancing. If you refinance your loans, keep your same interest rate, but extend your repayment term to 15 years, your payment would drop to only $ per month.

Buy Gold In Stock Market

Investors generally buy gold as a way of diversifying risk, especially through the use of futures contracts and derivatives. The gold market is subject to. Gold trading is an attractive investment, but can also be high risk. Before you trade gold commodities, futures or stocks read our guide to trading gold. The most direct way to buy gold is to purchase actual gold bars or coins, but these can be illiquid and must be stored securely. Exchange-traded funds (ETFs). Good Buy or Goodbye? ETF Report · Financial Freestyle · Capitol Gains · Living Sector winners. Gold ETFs are purchased through stockbrokers who use the funds you've invested to purchase gold bullion (gold that is officially recognized as being at least. The value of gold doesn't tend to move in line with other assets such as shares or property, and often rallies when stock markets fall. This lack of. What are the different ways to invest in gold? · Purchasing physical gold · Gold-linked currency investments · Gold ETFs or unit trusts · Gold mining stocks. 1. Purchase physical gold. Bars · 2. Invest in gold stocks. You can invest in gold without ever touching a flake of it by purchasing shares of gold mining. 1. Gold ETFs Gold Exchange Traded Funds (ETFs) are one of the most popular and cost-efficient ways if you are looking for how to trade gold in the stock. Investors generally buy gold as a way of diversifying risk, especially through the use of futures contracts and derivatives. The gold market is subject to. Gold trading is an attractive investment, but can also be high risk. Before you trade gold commodities, futures or stocks read our guide to trading gold. The most direct way to buy gold is to purchase actual gold bars or coins, but these can be illiquid and must be stored securely. Exchange-traded funds (ETFs). Good Buy or Goodbye? ETF Report · Financial Freestyle · Capitol Gains · Living Sector winners. Gold ETFs are purchased through stockbrokers who use the funds you've invested to purchase gold bullion (gold that is officially recognized as being at least. The value of gold doesn't tend to move in line with other assets such as shares or property, and often rallies when stock markets fall. This lack of. What are the different ways to invest in gold? · Purchasing physical gold · Gold-linked currency investments · Gold ETFs or unit trusts · Gold mining stocks. 1. Purchase physical gold. Bars · 2. Invest in gold stocks. You can invest in gold without ever touching a flake of it by purchasing shares of gold mining. 1. Gold ETFs Gold Exchange Traded Funds (ETFs) are one of the most popular and cost-efficient ways if you are looking for how to trade gold in the stock.

The 22 Best Stocks to Buy Now in September (). 1 day ago • The Motley ("COMEX") are not related to The NASDAQ Stock Market ("NASDAQ"). The marks. Gold miners 'ripe' for a break out: Analysts name stocks to buy as gold soars August 22, 4wdcentre82.ru Gold prices hit a fresh high and are set to rally. Gold can be bought in various forms—bullion, coins, or indirectly through exchange-traded funds (ETFs). Risk vs Reward: The Core Trade-off. When investing, it's. The second way is through investment in gold-backed financial instruments like Exchange-Traded Funds (ETFs) or sovereign gold bonds, and a third is through. This guide will help you start investing money in the gold market. We'll explore all the ways you can invest in gold and discuss their pros and cons. We'll also tell you about the other ways you might choose to buy gold: i.e. coins and small bars, ETFs, certificates, gold futures and mining stocks. When you'. They can add equity-like performance with bond-like protection to your portfolio. How to find opportunities in the bond market. The world of fixed income. This is why, traditionally, gold is seen as a 'safe-haven' investment. In times of market volatility, where stocks and shares plummet, part of this decrease is. Buying Digital Gold A digital precious metal programme offers an alternative way to access the precious metals market by purchasing part shares in larger gold. Bullion: One way you can invest in gold is to buy physical gold. · Gold mining stocks: You can also invest in gold mining stocks. · ETFs: There are also many gold. If sold in a declining market, the price you receive may be less than your original investment. Unlike bonds and stocks, precious metals do not make interest or. The commodity can be traded as physical gold, stocks and futures, including contracts for differences (CFDs) and exchange-traded funds (ETFs). Buying bullion. Shares in physical gold ETFs can be bought and sold similarly to shares of companies through exchanges. Physical gold ETFs are targeted at both individual and. The US dollar is in crisis mode because it is loosing its value in international market. Is gold (digital, stocks) really worth it? 31 upvotes. Fidelity offers additional ways to gain exposure to precious metals. For example, you can purchase mutual funds and exchange-traded funds (ETFs) that invest in. 1. Purchase physical gold. Bars · 2. Invest in gold stocks. You can invest in gold without ever touching a flake of it by purchasing shares of gold mining. Explore in-depth financial insights on Gold Futures. Gain instant access to the live Gold price, key market metrics, trading details, and intricate Gold futures. The easiest way to invest in gold and silver is to buy one or more exchange-traded funds (ETFs). How to Invest in Stocks and the Stock Market · A Concise. Shares in physical gold ETFs can be bought and sold similarly to shares of companies through exchanges. Physical gold ETFs are targeted at both individual and. Here are a few of the other shares that appeared to be affected by New York Stock Exchange technical woes Precious Metals This Gold-Mining Stock Is a Buy—and.

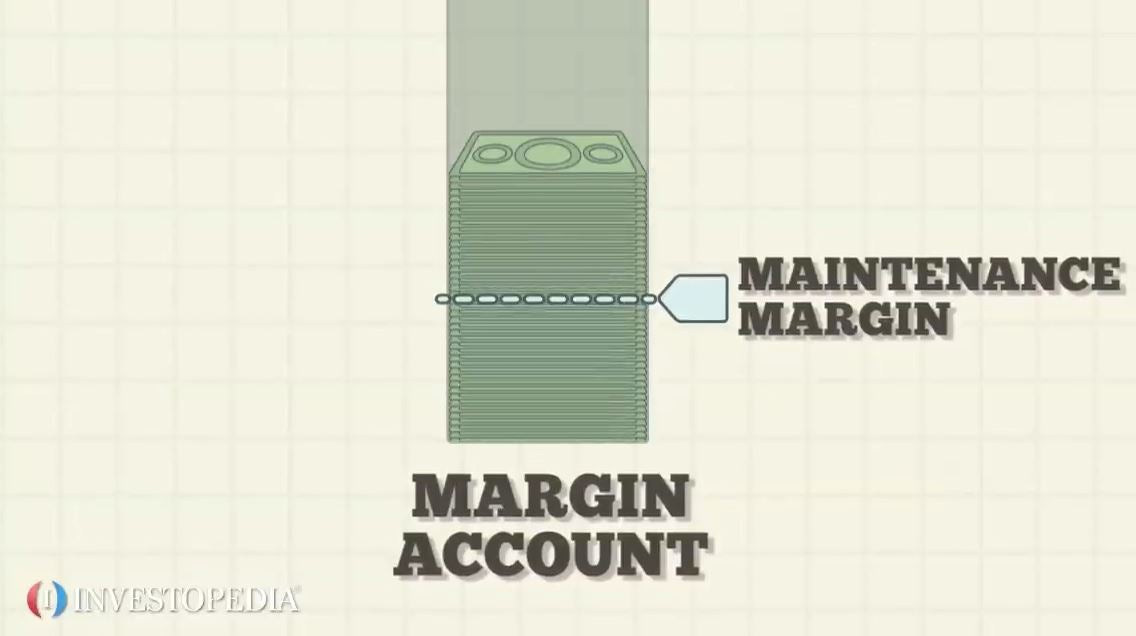

Purchase On Margin

The margin account of moomoo trading app identifies which stocks are marginable and shortable, along with the margin and loan rates. You could decide if you. Buying on margin refers to the purchase of securities using financial leverage (cash loaned by the broker). Buying on margin is borrowing money from a broker to purchase stock. You can think of it as a loan from your brokerage. Margin trading allows you to buy more. All securities purchased in a margin account will be automatically paid for from your core position first, followed by any money market. If you choose to borrow funds for your purchase, Merrill's collateral for the loan will be the securities purchased, other assets in your margin account and. A “margin account” is a type of brokerage account in which the broker-dealer lends the investor cash, using the account as collateral, to purchase securities. Brokerage customers who sign a margin agreement can generally borrow up to 50% of the purchase price of new marginable investments. Buying on margin allows an investor to buy securities partially with his or her own funds and partially with funds borrowed from a broker. To buy on margin. Trading on margin enables you to leverage securities you already own to purchase additional securities, sell securities short, or access a line of credit. The margin account of moomoo trading app identifies which stocks are marginable and shortable, along with the margin and loan rates. You could decide if you. Buying on margin refers to the purchase of securities using financial leverage (cash loaned by the broker). Buying on margin is borrowing money from a broker to purchase stock. You can think of it as a loan from your brokerage. Margin trading allows you to buy more. All securities purchased in a margin account will be automatically paid for from your core position first, followed by any money market. If you choose to borrow funds for your purchase, Merrill's collateral for the loan will be the securities purchased, other assets in your margin account and. A “margin account” is a type of brokerage account in which the broker-dealer lends the investor cash, using the account as collateral, to purchase securities. Brokerage customers who sign a margin agreement can generally borrow up to 50% of the purchase price of new marginable investments. Buying on margin allows an investor to buy securities partially with his or her own funds and partially with funds borrowed from a broker. To buy on margin. Trading on margin enables you to leverage securities you already own to purchase additional securities, sell securities short, or access a line of credit.

Buying stocks on margin is essentially borrowing money from your broker to buy securities. That leverages your potential returns, both for the good and the bad. If you choose to borrow funds for your purchase, Merrill's collateral for the loan will be the securities purchased, other assets in your margin account, and. Buying on margin occurs when an investor borrows part of the funds from a financial broker to purchase financial assets like stocks. For example, if you have. Margin accounts offer the ability to leverage your assets and increase your buying power. This financial maneuvering offers several advantages, but comes with. Margin trading, or buying on margin, means offering collateral, usually with your broker, to borrow funds to purchase securities. In stocks, this can also mean. Buying on margin is a trading strategy that involves borrowing money from a brokerage to purchase investment assets (usually a security like stocks or. Buying on margin refers to borrowing money from a broker to purchase stock. With a margin account, investors can boost their financial leverage by using. Here's an example: Suppose you use $5, in cash and borrow $5, on margin to buy a total of $10, in stock. If the stock rises in value to $11, and you. With Wells Fargo Advisors, you can buy stocks on margin to extend the financial reach of your account. For more information, contact our investment. Buying on margin is the process in which an investor purchases an asset with leverage by borrowing a balance from a bank or a stock broker. Margin trading can offer you more buying power, access to ongoing credit, and competitive interest rates. I had an idea that if I bought on margin, it essentially turns my investing into an obligated bill that I have to pay. purchase price of a margin equity security for new purchases. Regulation T only sets the initial margin requirements on equity securities but FINRA's margin. Buying on margin means that you purchase securities using some of your own cash and you take a loan from your broker to complete the purchase. The collateral. Although the initial margin requirement of ABC stock is 50%, the maintenance margin requirement of ABC is 30%. $10, * (%%) = $7, → the maximum. Buying on margin means buying more securities with the money borrowed from a bank or a broker. Margin buying enhances an investor's ability to purchase more. Borrow up to 50% of your eligible equity to buy additional securities. Powerful tools, real-time information, and specialized service help you make the most of. An investor who purchases securities may pay for the securities in full or may borrow part of the purchase cost from his brokerage. Buying on margin is borrowing money from a broker to purchase stock. Example: Margin trading allows you to buy more stock than you'd be able to normally. Buying on margin is borrowing money from a broker to purchase stock. You can think of it as a loan from your brokerage.

Bank Quarters

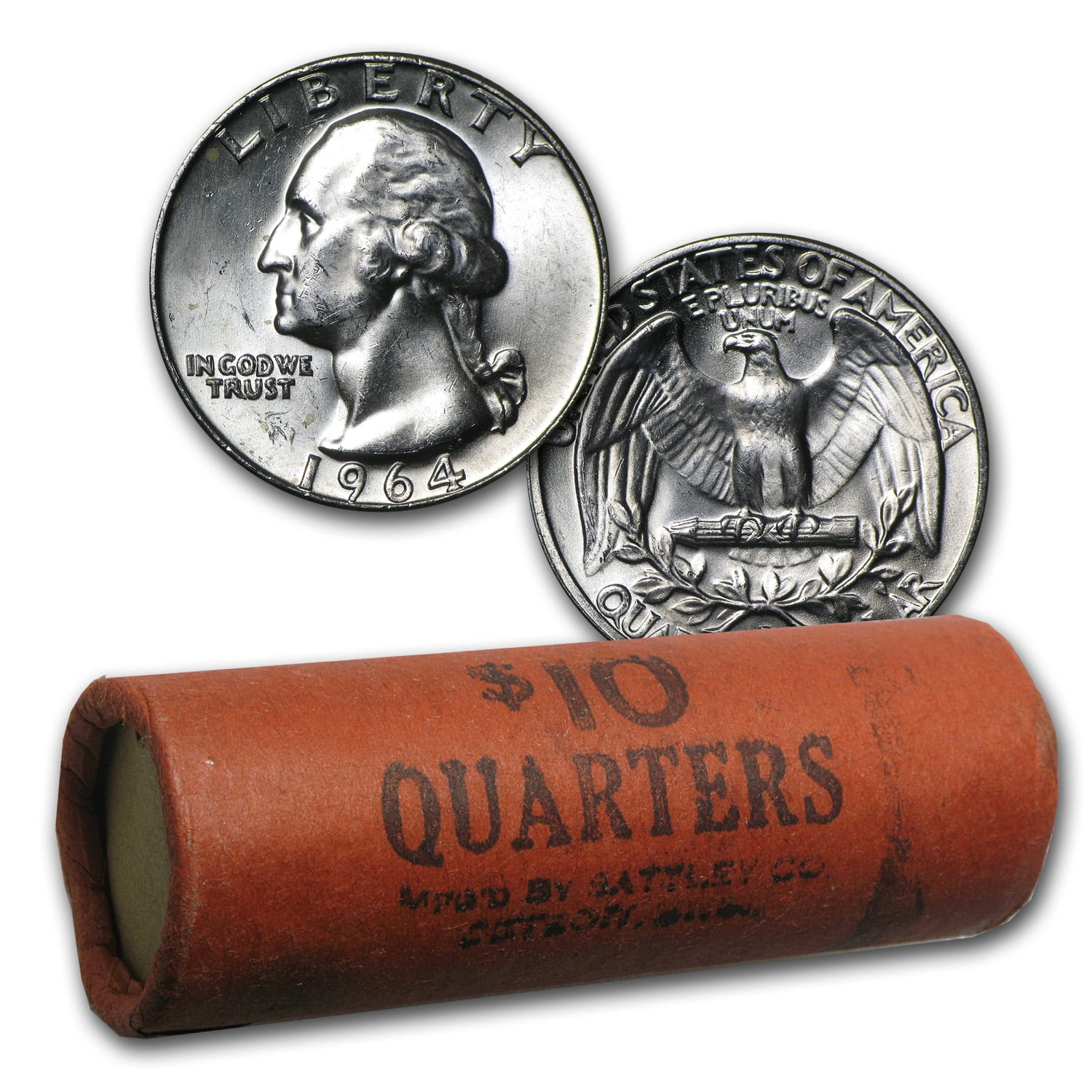

Discover all the information on the Bank's quarterly results. Second Quarter Earnings Review · View Presentation. Latest Financial Results. Q2 Quarter Ended Jun 30, Earnings Release · HTML PDF · Earnings. A quarter is a three-month interval that serves as the foundation for regular financial statements and dividend payouts. Major banks often signal the start of each earnings season, almost racing to file the first reports of each quarter. The tech sector comes next, followed by. Quarterly Public Sector Debt Statistics · Public Sector Balance Sheet Database Bank for International Settlements · European Central Bank · Eurostat. Rather, it is best viewed as a running estimate of real GDP growth based on available economic data for the current measured quarter. There are no subjective. Total household debt rose by $ billion to reach $ trillion, according to the latest Quarterly Report on Household Debt and Credit. · Fourth Quarter · Third Quarter · Second Quarter · First Quarter Banks: Most banks can provide you with specific denominations of currency, including one-dollar bills. You can visit a teller and request the. Discover all the information on the Bank's quarterly results. Second Quarter Earnings Review · View Presentation. Latest Financial Results. Q2 Quarter Ended Jun 30, Earnings Release · HTML PDF · Earnings. A quarter is a three-month interval that serves as the foundation for regular financial statements and dividend payouts. Major banks often signal the start of each earnings season, almost racing to file the first reports of each quarter. The tech sector comes next, followed by. Quarterly Public Sector Debt Statistics · Public Sector Balance Sheet Database Bank for International Settlements · European Central Bank · Eurostat. Rather, it is best viewed as a running estimate of real GDP growth based on available economic data for the current measured quarter. There are no subjective. Total household debt rose by $ billion to reach $ trillion, according to the latest Quarterly Report on Household Debt and Credit. · Fourth Quarter · Third Quarter · Second Quarter · First Quarter Banks: Most banks can provide you with specific denominations of currency, including one-dollar bills. You can visit a teller and request the.

Bank; best second quarter Global Markets revenues on record 2 and underlying Global Banking revenues up 55% YoY, significantly outperforming the fee pools. "Business quarter" redirects here. For the business centre of a city, see Central business district. All the key company information and financial results you need each quarter. All; Interim Report – Credit Suisse AG (Bank); Previous Interim Reports – Credit. Financial Data Download. Holding Company Financial Data. Each quarterly file contains all variables reported at the time of the respective financial. Q2 Quarter Ended Jun 30, ; Q1 Quarter Ended Mar 31, Freedman's Bank Building · Careers · At Headquarters · At Our Bureaus · Top 10 DOCUMENTS RELEASED at PM Friday, JULY 12, Primary Dealer Meeting. If you need a lot of quarters — $10 or more — your best bet is a bank. Banks keep quarters in $10 rolls containing 40 quarters each. Commercial Banking · Corporate & Investment Banking · ATMs/Locations · Customer Information contained in a quarterly earnings release speaks only as of the. You are here: 4wdcentre82.ru · Taxes. Prescribed interest rates. Fourth calendar quarter Quarterly Bulletin Publications, Quarterly Bulletin Time Series Descriptions, Secondary School Assignments, Supplements, Table Changes. Quarterly Results. Q1. Q2. Q3. Q4. Post-Quarter Information. News Release TD Bank Commercial Banking · TD Auto Finance · TD Wealth Private Client Group · TD. Quarterly and Annual Reports. Reports Year: RBC Investor Relations. Acquisitions & Divestitures · Contact Us. Royal Bank of Canada Website, © The Annual Report outlines the Bank's activities and achievements in It includes the financial statements and a message from Governor Tiff Macklem. Quarterly Earnings Release. Tuesday, October 15, AM ET. Quarterly Reporting Dates Opens in a new window Quarterly Reporting Dates Opens in. Quarterly Results · Q3 Quick Facts · Q3 Investor Presentation · Sustainability Report · TD's Climate Action Plan: Progress Update · They are boxed in $ units. Most banks have a small coin vault that might hold as many as 20 boxes of quarters assuming there is some room in there also for. BNY, BNY Mellon and Bank of New York Mellon are the corporate brands of The Bank of New York Mellon Corporation and may be used to reference the corporation as. Although many anticipate lower interest rates in September, we are prepared if that does not come to pass,” said Mr. Franklin. “Stellar Bank is well-positioned. Every national bank, state member bank, and insured nonmember bank is UBPR data for the most recent quarter is updated daily and for the five most recent. Bank for International Settlements. Countries reporting the international banking statistics with the first quarter when data are available. 1 Apr

Average Price Of Ac Install

National average range of AC installation cost is from $1, (low end) to $11, (high end). The average is generated by statistics provided by thousands of. A central AC unit install can range from $ to $ However, several factors go into the price which you can review before receiving an estimate. The cost to purchase a unit and have it installed by a professional air conditioning services provider can be anywhere from $ to $10, or more. Simple. The size of your air conditioning unit will also determine how much replacement will cost. For instance, if your replacement system has a SEER rating between While I don't have real-time pricing information, a quote of $14, for a sqft home including both the AC and furnace could be reasonable. Investing between $4, -$12, for an efficient Central Air Conditioner system. The installation and replacement costs cover only the central AC unit and. The average central AC unit cost is $5,, with most homeowners spending somewhere between $3, and $8, to have an HVAC professional install a central AC. The national average cost range for installing central AC is $5, to $14,, with most homeowners paying $8, to install a new 3-ton split system unit. Air conditioner installation costs typically range from $3, to $7,, but many homeowners will pay around $5, on average. Air conditioners turn your. National average range of AC installation cost is from $1, (low end) to $11, (high end). The average is generated by statistics provided by thousands of. A central AC unit install can range from $ to $ However, several factors go into the price which you can review before receiving an estimate. The cost to purchase a unit and have it installed by a professional air conditioning services provider can be anywhere from $ to $10, or more. Simple. The size of your air conditioning unit will also determine how much replacement will cost. For instance, if your replacement system has a SEER rating between While I don't have real-time pricing information, a quote of $14, for a sqft home including both the AC and furnace could be reasonable. Investing between $4, -$12, for an efficient Central Air Conditioner system. The installation and replacement costs cover only the central AC unit and. The average central AC unit cost is $5,, with most homeowners spending somewhere between $3, and $8, to have an HVAC professional install a central AC. The national average cost range for installing central AC is $5, to $14,, with most homeowners paying $8, to install a new 3-ton split system unit. Air conditioner installation costs typically range from $3, to $7,, but many homeowners will pay around $5, on average. Air conditioners turn your.

Installing central air conditioning typically costs between $3, and $7,, with an average cost of $5, The final price depends on various factors. In April the cost to Install Air Conditioning starts at $6, - $8, per unit. Use our Cost Calculator for cost estimate examples customized to the. Average cost to install central air conditioning is about $ (central A/C + Labor Cost (install AC unit), $38, per hour, 16, $ 4. + Labor Cost. Typical Air Conditioner Cost. Many homeowners spend around $4, on a new air conditioner, according to national averages compiled by HomeGuide. Air. While I don't have real-time pricing information, a quote of $14, for a sqft home including both the AC and furnace could be reasonable. The average central AC unit cost is $5,, with most homeowners spending somewhere between $3, and $8, to have an HVAC professional install a central AC. Average AC Servicing Cost · The cost of installing a new air conditioner ranges from $3, to $7, · Cleaning the ducts in your air conditioner costs between. In , homeowners on average pay $ for a central air conditioner unit installation. The main factors that affect the cost of your AC unit include your. The size of your air conditioning unit will also determine how much replacement will cost. For instance, if your replacement system has a SEER rating between What are the typical installation and unit costs for each size? · ton units cost approximately $1, plus $4,+ for installation. · 4-ton units cost. Air conditioner installation costs typically range from $3, to $7,, but many homeowners will pay around $5, on average. Air conditioners turn your home. The average cost for an air conditioner replacement in Chicago ranges from $5,$9, on the low-end, $9,$14, in the mid-range, and upwards of $15, A new outdoor AC unit installation costs the average homeowner $3, to $4, for a basic outdoor air conditioner replacement. Your Complete AC Unit Cost. An air conditioner will cost more for larger homes. The typical range for smaller systems is about $3, For larger and upgraded systems, expect to pay around. A no frills, minimum efficiency air conditioner will cost you as little as $7, installed, while a full featured, high-end, high efficiency air conditioner. Totals - Cost To Install Room Air Conditioner, 1 EA, $, $1, Average Cost per Unit, $, $1, Pros. Edit, Print & Save this in Homewyse Lists. Most air conditioner repair costs range between $ to $, which can also be higher if need be. The cost also depends on the contractor you hire. While some. Average AC Servicing Cost · The cost of installing a new air conditioner ranges from $3, to $7, · Cleaning the ducts in your air conditioner costs between. The average cost of central air conditioning installation ranges from $5, to $12, in New Jersey. Meanwhile, replacement costs including labor can range. Here's a quick look at average costs for various AC systems: Central Air Conditioning Systems: $3, – $7,; Ductless Mini-Split Systems: $2, – $5,

1 2 3 4 5 6 7